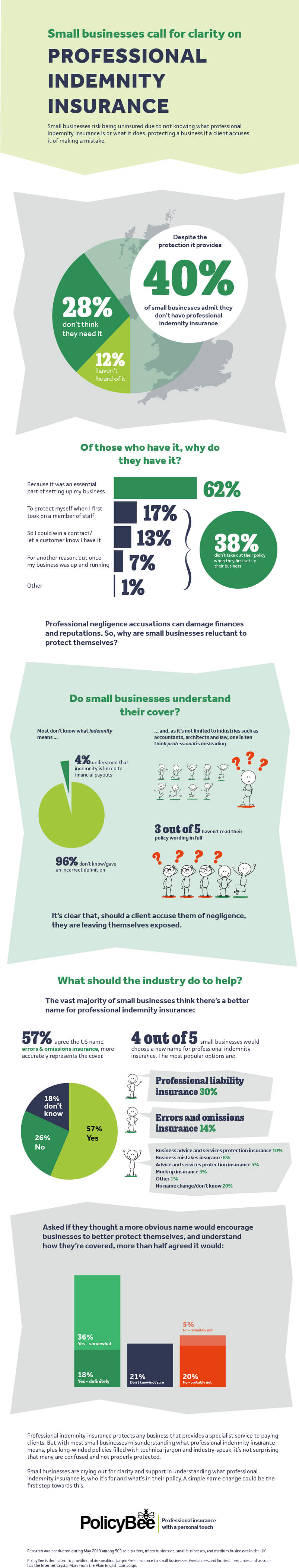

We recently conducted a survey among UK small businesses and found the number operating without professional indemnity (PI) insurance is a worryingly high 40%.

That’s two out of every five small businesses not covered if a customer or client accuses them of professional negligence and decides to sue.

12% of those without PI claim they haven’t heard of it so can probably be excused. How can they be expected to buy something they don’t know exists?

28% of those without PI said it was because they didn’t think they needed it. How can a business decide against such reassurance and protection?

Well, one of the main reasons is that there’s lots of confusion about the product name itself.

Clear as mud

Of the 500+ small businesses we asked, 96% couldn’t accurately define the word indemnity. Some tried and were a bit wrong; others tried and were really wrong. And then there were those who didn’t try at all, admitting they simply didn’t know.

It’s obviously not a commonly used word - we totally get that - and if a business doesn’t understand that indemnity is ‘a financial payout to cover loss or damage’, it’s not likely they’ve got their head around what the product name means.

And that’s not all that’s confusing the UK’s small businesses. Turns out one in ten actually think the word professional is misleading too.

Professional indemnity insurance protects any business that provides a specialist service to paying clients. Any business. Not just ‘professional services’ like architects, engineers, doctors, and lawyers who need professional licenses.

That means photographers, hairdressers, even teachers should be looking at getting PI, but many don’t think it applies to them.

Make insurance great again

We asked our participants if they thought the US name for the same kind of protection, ‘errors & omissions insurance’ (E&O), was better.

Well, over half (57%) agreed the words errors and omissions more accurately represent the cover, presumably because that’s what a business is actually covered for: if it makes a mistake, or fails to do something it’s promised.

We agree. So we asked businesses about other possible names for professional indemnity insurance. Even more popular than America’s E&O, the most preferred alternative name was ‘professional liability insurance’ … another US term.

‘Business advice & services protection insurance’ was third most popular. What it lacks in brevity, it makes up for in being both descriptive and representative of how a business is covered.

Small businesses reckon that changing PI’s name to a more obvious one would help clarify the cover and therefore show businesses they really do need it:

The IT guy without PI

After some encouragement from a friend, Martin, who’d been working part-time as the library's IT technician, decided to go it alone as a freelance IT consultant.

Unfortunately, Martin failed to back up one of his new clients' databases, the entire data set was corrupted during a routine update, and as a result the client lost a huge chunk of their customer details.

As a brand-new one-man-band, Martin had vaguely heard of PI but thought it probably didn’t apply to him. Now he had an expensive legal battle on his hands, as well as damage to his reputation, and no-one fighting his corner.

Had he had PI insurance, his insurer could have helped him sort out the situation and paid compensation if it came to it. Although it would've been a valuable lesson, it wouldn't have been a business-crippling disaster.

How to fix professional indemnity insurance

If this survey is anything to go by - and we think it is - the first step involves nothing more than a name change. But obviously that’s actually a pretty tall order and something that would need to be addressed as an industry.

Maybe, then, the answer lies in plain speaking and using simple, understandable, everyday words. Our research shows there's certainly a need for it.

And why should we have a say? Because we’re a broker. It’s our job to be the middleman between sometimes long-winded, jargon-filled insurance policies and the people who need them: sole traders, freelancers, and small businesses.

We're doing what we can.

Unfortunately, this issue is bigger than just one company. If the insurance industry as a whole was to respond to this call for clarity, then the UK’s small business community might just be better insured.

See the survey results for yourself. And feel free to share far and wide.

Embed this infographic by copying and pasting this code:

Infographic by PolicyBee