Internet technology has been billed as the great liberator. And there’s no doubt it’s freed up businesses to trade in evermore sophisticated ways.

But it’s also brought new risks in the form of cybercrime. The kind of risks that cost small businesses in the UK £17 billion in 2018, according to business internet service provider, Beaming.

That risk is growing as hackers up their game. So, being in the business of helping businesses reduce their risks, we thought we’d find out how many of you out there have already done something to protect your business from cyber-attacks.

Numbers speak volumes

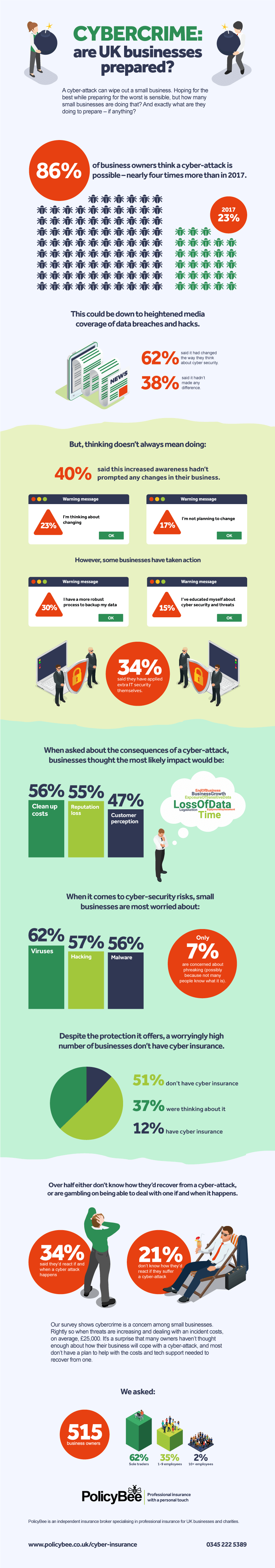

We surveyed 500 small business owners from across the UK and, somewhat shockingly, found that almost 90% have NO insurance that covers them for cybercrime. Zilch. Nothing.

That’s worrying when 56% of those surveyed said the main likely impact on their business would be the clean-up cost. Even more so when the damage cyber-attacks inflict on small businesses averages £25,000 a hit, according to insurance provider Hiscox.

Hiscox also estimates that a shocking one-in-three small businesses suffered a cyber-attack in 2018 – with one business attacked every 19 seconds. Phishing, ransomware, social engineering, malware, phreaking, viruses, website defrauding and hacking were all in the mix. (More about what these are here.)

So, on that evidence, an attack looks likely. That's something 86% of our respondents agree with, which makes it even more crucial to protect your business from cyber-attacks. Yet somewhat scarily, almost 40% say they haven’t put any additional measures in place.

Small steps

Some businesses have at least made a start by putting extra IT security in place (34%), finding a more robust way to back up data (30%) and educating staff on how to spot and steer clear of scammers (15%).

A small step in the right direction, then.

However, the reality is that there’s no foolproof way to prevent an attack. Hackers are clever, employees can sometimes be fooled into clicking things they shouldn’t, and all the IT security in the world won’t guarantee your systems are invincible.

In fact, there’s been a rise in the number of cyber-attacks being reported, suggesting this is a ‘not if but when’ situation. Beaming’s research found that nearly two-thirds (63%) of small businesses fell victim to cybercrime in 2018 – up from 47% in 2017 and 55% in 2016.

Rather ominously, more than a third (34%) of the businesses we asked said they'd react with a recovery plan only if and when a cyber-attack happened. That, however, would be too little too late, since the key to surviving an attack is being prepared and reacting quickly.

How to protect your business from cyber-attacks

A three-pronged approach is best to protect your business from cyber-attacks:

1. Make your IT security the best it can be

If you use computers, email, have a website or store data electronically, think about how to protect yourself now. So:

- Make sure you install all security updates as soon as they’re available

- Encrypt your data

- Backup your files regularly and store copies remotely

- Change passwords frequently

There's always more you can do with your tech, and it's worth investing in an IT specialist's expert advice.

2. Train your staff

More than nine in ten (92%) of the people we surveyed said cybersecurity is the MD's, CEO's or owner's responsibility. But it only takes one member of staff to click on a malicious link in a bogus email to have a breach.

That’s why it’s important to educate and train all your staff. Make sure they know what to look out for, what to avoid, and how to handle any suspicious-looking emails.

3. Get the right cover

The right insurance helps you when you need it most. That’s because time is of the essence when you’re hit by a cyber-attack. You need to deal with the situation and get your business up and running again as quickly as possible.

Cyber insurance not only gives you tech help to stop an attack, repair your systems and get your website back up, it also pays for legal muscle and covers compensation if you’re sued for losing people’s personal data. Plus, it takes care of your lost income while you can’t trade as normal.

It does a whole bunch of other stuff too, but most importantly, it means you’re both prepared for a possible cyber-attack and protected from the worst consequences of one. And that makes good business sense.

If you want to be covered for things like social engineering and financial crime, check your policy - sometimes it's an added extra. But one well worth having.

Find out more about cyber insurance and how to protect your business from cyber-attacks by clicking here.

Thanks to cyber risk management specialists KYND for supporting our survey with the offer of a free cyber risk summary for all respondents.

To embed this image - copy and paste the code below

cyber liability insurance

Infographic by PolicyBee